PCI SSF Compliance to Safeguard the Application from the Software Development Stage

PCI SSF Compliance

Digitalization has made life a lot easier as one can enjoy luxury at the click of a button. Different online facilities available include shopping for appliances, groceries, medicines, apparel, etc. To safeguard payment card industry, new framework is implemented by PCI council which is called the PCI SSF. By 2022 October, the PA DSS will be replaced by PCI SSF compliance certification.

This change over is to PCI SSF complianceis to safeguard both existing applications and latest payment application that were introduced in the payment industry.

Why is PCI SSF compliance necessary?

Any software application should follow the rules set for its proper functioning. In the case of the online payment application software, the Payment Card Industry Data Security Standards (PCI DSS)is the main authority, put forward latest PCI Software Security Framework (SSF).

PCI DSS has set dome security requirements that the software should pass to gain compliance. Organization having the PCI DSS compliance is recognized safe for making online payment transactions. People feel a sense of safety and security while making the payment using such a PCI DSS compliant organization.

Some of the benefits of PCI SSF compliance

With this changeover, the customers can enjoy several benefits such as

The new guidelines are suitable for both existing payment application software and the latest payment system.

Mange risks for any kind of payment application

Increased data protection of the customers

Reduce negative cash flow.

Avoid penalties: When a payment system become the victim of fraudulent and unauthorized activities, the organization have to pay huge penalty unless it has compliance with PCI standards and guidelines

Enhance customer trust and confidence: The PCI SSF compliance is more sophisticated and capable of safeguarding even against latest payment vulnerabilities.

This brings in more customer trust and confidence.

Security breaches or fraud are very expensive. The organization must bear a huge cost for paying the various penalties and fines. Having the PCI DSS compliance ensures there are reduced chances of breaches thus reducing the costs incurred in case of breaches.

By having the organization to get PCI SSF compliance, which makes the customers feel safe dealing with the organization with the PCI DSS compliance. The organization gains a reputation in the market by attracting more customers to its products and services.

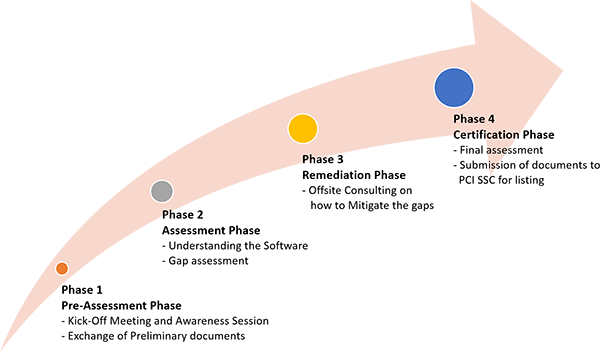

For knowing the robustness of the application, a stringent check or audit is carried out for the application. The auditor or accessor who is a qualified and certified accessors ensures that the application has all the qualifications or requirements necessary for having PCI SSF compliance.

The audit which defines the whole performance of an organization is an appraisal activity. This activity is done by IS auditors with an objective to detect and prevent errors and vulnerabilities of your information system and to provide safe and secured system. To achieve a successful and effective result, it is important for the employees in the organization to cooperate with the auditors.